Want to save your payroll calculator data, access payroll reports, and offer pay stubs? Paycheck Manager’s paid plan costs $5 a month after a three-month free trial. If Paycheck Manager’s calculator seems too complex, you can use its simple calculator to make basic tax estimates. Want another easy, streamlined option for payroll calculation only? Like eSmart Paycheck, Paycheck Manager’s free calculator lets you calculate an employee’s net salary, then print paychecks and create pay stubs. It lists a lot of features and includes a handy user guide for getting started, but we're a little wary of its lack of product details. Plus, HR.my’s site is the sparsest we’ve reviewed. This makes the translation quality hit or miss.Īlso, HR.my is based in Malaysia, which could be a problem for US-based customers who need customer service support during regular business hours. First, every language translation except for English and Chinese relies entirely on Google Translate with no human oversight. Mobile payroll app (Android and iOS) for employers and employees.Unlimited employee web accounts for pay stub access and PTO requests.Unlimited users, including employees and managers.Multiple pay schedules, including weekly, biweekly, semi-monthly, and monthly.Attendance management and time clock integration.Beyond its multiple tongues, the title serves up comprehensive payroll-processing features that compare to both TimeTrex’s and Payroll4Free’s.

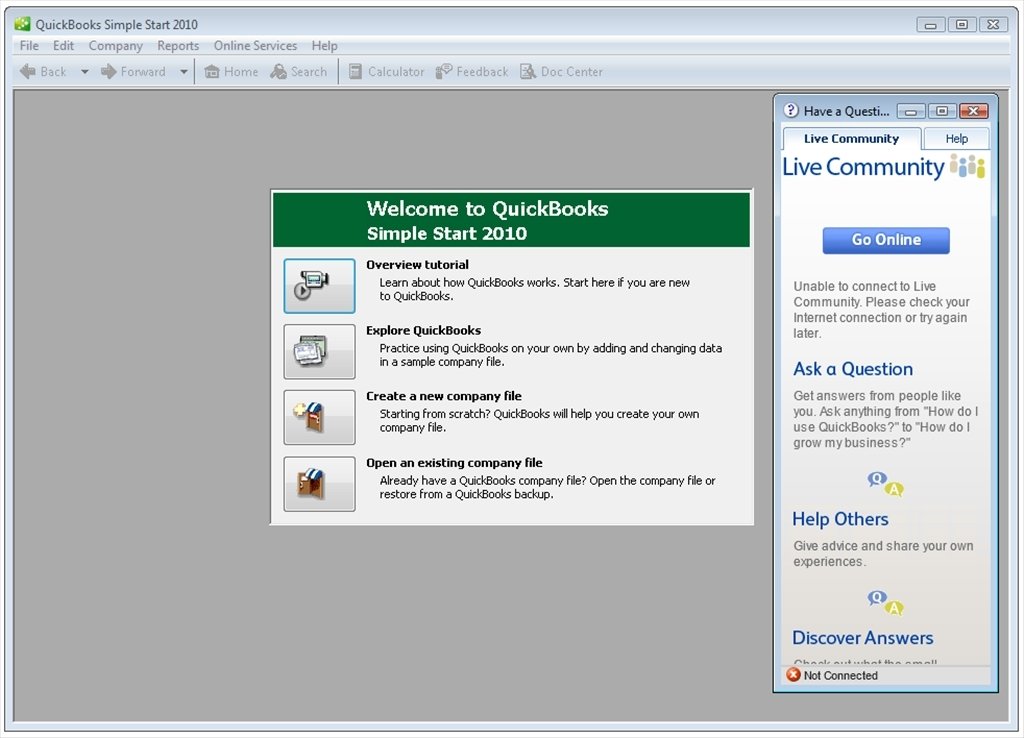

Unlike the majority of payroll software-both free and paid-HR.my's payroll software is available in 65 different languages. This might feel distracting and cumbersome, although this marathon of marketing doesn’t fundamentally alter your payroll process. Payroll4Free is only gratis because it's loaded with advertisements. Afterall, the title’s made for getting the job done at no cost, so you get what you pay for when it comes to user-friendliness and visual allure. The platform is barebones, so most of the features mentioned above require patience and some basic administrative knowledge. Now that you know the good stuff, here’s the catch. You have to do the actual filing, but form filling is easily the most time-intensive part of the process.ĭon’t worry though if you’d prefer to let someone else handle taxes: the company offers full-service tax filing for a below-average $15 monthly fee. (Even many paid providers don’t include those features with their cheapest plans.) And while Payroll4Free can’t file your payroll taxes for free, it calculates payroll tax deductions and autofills the tax forms. Payroll4Free’s reporting and paid time off (PTO) tracking features are particularly impressive. Accounting software integration, including QuickBooks.Paid time off, vacation, and sick time accruals.Reports on taxes, benefits, payroll statistics, and more.Federal, state, and local payroll tax calculations.1099 contract and W-2 employee payments.For one thing, it’s chock-full of functions that are often enjoyed only in premium, top-tier platforms. Payroll4Free is a master in the free payroll software genre. Oh, and if you’re interested, we also offer a few free payroll aids: This means you can always give premium software a go and cancel if you find it doesn’t meet your needs. In particular, ADP has a three-month-long free trial, SurePayroll has a two-month free trial, and Gusto has a one-month free trial. Ultimately, if you’d prefer not to take chances, most paid payroll providers offer free trials. This means you’re on your own if Uncle Sam busts down your door with a nasty tax bill in hand. While this is good advice in general, it’s particularly crucial in this no-cost software genre since most free payroll services do not offer any calculation accuracy guarantees.

#Simple accounting software free for free

If you do choose free payroll software, make sure to keep detailed financial records (which you can do for free with free accounting software) and to double- and triple-check your paycheck and tax calculations. (The main exception is Payroll4Free, which supports payroll for up to 25 employees and has many features that are similar to some paid self-service payroll providers.) That’s why we and most of our top free payroll picks tend to recommend free software only to businesses with 10 or fewer employees.

Plus, as your workforce grows, you’ll need more sophisticated software that exceeds what most free payroll services provide. Payroll mistakes can have huge financial consequences not just for your employees but for your business, especially once the IRS gets involved. Payroll is complex, and it only gets more complex the more employees you have.

0 kommentar(er)

0 kommentar(er)